Integrated Financial Training: Westchester NY |

|

Empowering you to Manage your Money and your Happiness |

|

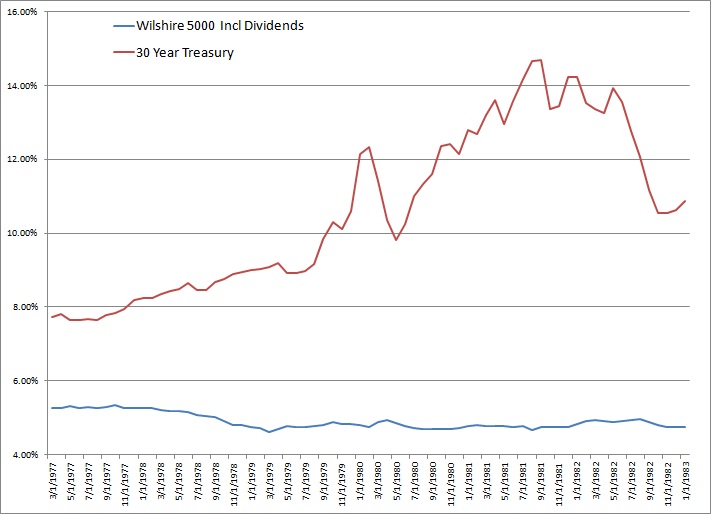

The best plans take into account the worst scenarios, not with an act of denial. Summary Jeremy Siegel wrote a book explaining why stocks are a good deal for long term investors. He explained in an interview that while he believes the risk of stocks do go up over time, they do not go up as much as they should. The financial press often states that the risk of stocks go down over the long run, but this notion is incorrect. By trying to maximize wealth without considering how the wealth accumulation can be used to pay future expenses essentially solves the wrong problem. There are some circumstances where wealth maximization can be used, but typically only after one's ability to retire is secured. This article counteracts a widely held but unsupported view that simply investing in stocks is the solution to all your retirement needs. One should focus on the financial plan to determine which risks make the most sense. Stocks for the Long Run? In the financial world, both pension funds and life insurance companies have very long term liabilities, similar to individual investors. It is quite interesting to note that both have very different approaches to dealing with equities. For example, pensions often maintain positions as high as 60-70% in equities depending on the age of their workforce. But life insurance companies rarely have more than 10% of their assets in stocks. The financial press seems to favor the pension model. But even before the 2008 financial crisis, the pension fund industry was having serious problems.[1] Life insurance companies, on the other hand, have been performing much better. It is interesting to note that life insurance companies forecast their liabilities and buy assets with the intention of matching their liabilities very closely. They often have less than a one year mismatch. The mismatch for the pension industry by comparison is huge. So it is by no coincidence that with large swings in the financial markets, the pension industry could suffer greatly while the life insurance industry would simply keep chugging along. Professor Zvi Bodie suggests the financial press is getting it wrong - that the risk in stocks increases over time as opposed to decreasing and therefore financial pundits incorrectly recommend levels of equity exposure that are far too high.[2] Jeremy Siegel, Wharton Professor who wrote "Stocks for the Long Run" agrees that the risk in stocks does go up over time. However given that the one measure of variation (the standard deviation) goes down over time twice as fast for stocks as would be predicted by a random series, he feels stocks are a good deal for the level of risk.[3] Consider that we expect to do better over the long run in equities, but how long is the long run? To support the argument that stocks are not risky in the long run some market pundits claim stocks have outperformed bonds over every historical period of 30 years. This argument would cause Zvi Bodie's point some serious indigestion. So here is all data available on the 30 year treasury bond, comparing it to returns on stocks for the 30 year period that matches the term for the bonds:

The comparison is engineered to evaluate Zvi Bodie's challenge to the the riskiness of stocks. The 30 year treasury rates begin 2/15/1977 and stock returns end 1/1/2013 (care of FRB St Louis). The comparison is to buy a 30 year treasury on 3/1/77 or buy stocks on the same day to see where the return was higher when the 30 years are up. Here we can see, contrary to popular belief, that there was not a single period where stocks outperformed bonds. While one might argue that we were going into a period of historically high interest rates, 1977 did not begin in that fashion. The returns for stocks never beat the 1977 rates for bonds. Further, the period from 1982 to 1999 included the highest extended period of returns in the stock market for the entire century. So while stocks have outperformed bonds at times, we can clearly conclude that stocks have not always ouperformed treasury bonds for every 30 year period in history. This is the reason stocks are referred to as risky assets. A particular question arises here in discerning which model (pension or insurance) to apply for ourselves. For what is the purpose of our investing? Is it to make as much money as possible or is it to have the capacity to pay our bills? The first issue to tease out of this decision is the economic implications, which are straight forward. What are the risk and rewards of investing in stocks as they relate to our economic purpose - the ability to pay our expenses at a minimum? Fortunately there are ways to measure the amount of risk we are taking to determine if the deviation from our expenses will place us in serious jeopardy or not. For example, in our case study, we used a 60/40 stock/bond mix and a 10/90 mix with 88% in Treasury Inflation Protected Securities. The details suggest that the couple using the 60/40 mix suffered serious impairment with a $12,000 loss in living standard per adult. This occurred during circumstances that closely mirrored the greatest stock market rally of the 20th century followed by its dismal aftermath. With the 10/90 mix they did were not materially affected by stock market shifts. In their situation, the economics alone suggest 60/40 may be too risky for them. Two situations can arise where this economic conclusion may be put aside. First is where the family in question does not need to rely upon the money invested in stocks to maintain their critical needs. Here the same analysis would show they are not at risk of being unable to support themselves. The second arises where their purpose in life over rides the pure economic decision. In the first case, as our article on investment process suggests, greed should not play a part in that process. Instead, someone should think in terms of what wholesome objectives they wish to accomplish in the world and how such investments would support that activity. The second situation can arise in rare circumstance after one has properly gauged their ability to be patient during such difficult times. This sort of decision needs to be made with full consciousness, without glossing the risk or denying it in any form. The best plans are made with an understanding of the worst scenarios. Then one can turn to managing for better circumstances in an optimistic manner. Of course any strategy you choose is dependent upon your personal circumstances. This article highlights the need to be very clear on the purpose of investing and make sure we target that purpose with precision. We can start from a purely economic point of view which is represented by matching our assets against our expected expenditures in the future. Some may either complement or over ride this economic formula in favor of the real meaning of their lives. But taking such as stand should be done on a completely conscious level. If we unconsciously follow the crowd as they jump off a cliff without looking down, our happiness may be impaired for those few moments before we hit bottom. If you've made it this far, please email us feedback - tell us what you think and if there is any way to be more helpful. Legal - The purpose of this site and all services offered are educational in nature and not to provide any investment advice, planning or recommendations of any securities. The purpose is to educate you to make your own financial decisions, or prepare you to evaluate your financial advisors with confidence so you can gain trust in the services they provide.

[1] On Asset-Liability Matching and Federal Deposit and Pension Insurance, FRB St Louis 2006 [2] On the Risks of Stocks in the Long Run, FAJ 1995, or The Long Run Risk of Stock Market Investing: Is Equity INvesting Hazardous to Your Client's Wealth, FAJ 2011 [3] Great Debate NAPFA Apr 2004 Bodie vs.. Siegel |

Integrated Financial Education: Westchester NY - 168 Bell Rd, Scarsdale, NY 19583 914-648-0492