Integrated Financial Training: Westchester NY |

|

Empowering you to Manage your Money and your Happiness |

|

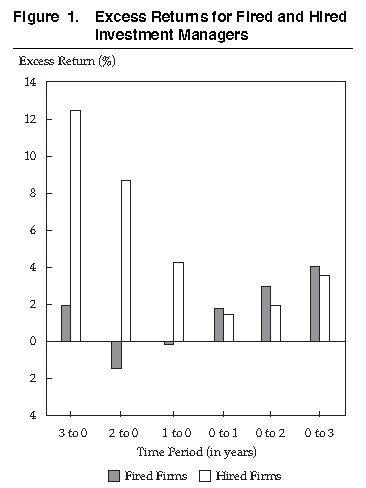

To move 1,000 pounds with 1 pound of pressure, or to move 1 pound with 1,000 pounds of pressure...that is the question.. Summary The financial industry spends enormous amounts of energy on actively managed mutual fund selection. But it is more likely to cost you money than provide benefit. If you are among the 1% who do benefit, chances are the benefit will be extremely small compared to focusing on your financial plan. A better starting point is to define your asset allocation in a solid financial plan and use low cost index funds. If you want to tweak things from there, it can make sense. But if you still want to know why or how to select a fund, read on... Mutual Fund Selection When investing, there are two basic philosophical approaches. The first says that you are simply making an investment. For example, the idea of investing in the stock market is just considered buying businesses. The question is what does the business do and does it make economic sense. Graham and Dodd are two famous professors who developed the approach. They trained practitioners such as Warren Buffet and John Templeton. Based upon their philosophy, they have done very well when measured by the market, but they have done so by ignoring the market. They only care where the market is when they buy and when they sell. But when most of us look to invest, we are not going so deeply into the economic philosophy. We are looking for an attractive return. We are swamped with ads and marketing pitches for why funds will beat the market in order to justify their high level of expenses. In the example below, we evaluate an actively managed fund whose expenses are 1.47% of assets every year. That compares to 0.20% for a passively managed fund. The additional 1.27% is compensation for their ability to provide returns that exceed the market. If they only match the market return (say 7%), over a 40 year period, our net worth would increase by 61% if we used the passively managed fund instead. That's quite an opportunity. In this article we will show the inside of the mutual fund business so you will how (and more importantly why)to navigate your decisions with a minimal effort. When such a large portion of your net worth is on the line, being efficient is important to protect the safety of your retirement. Before you ask how to select a fund, I will ask you why you want to select a fund? In a recent study of 1,000 institutional funds hired by pensions, endowments, etc., the underlying philosophy of hiring managers appeared to be by chasing those with positive returns recently. Sometimes a picture is worth 1,000 words:

This chart, from Murder on the Orient Express: TheMystery of Underperformance by Charles Ellis shows how the managers recently hired by these funds performed extremely well just prior to being hired. The firms fired had dismal performance for 3 years prior to being fired. After the change was made, the firms that were fired outperformed those that were hired. These managers had full time staffs of highly educated people dedicated to nothing but selecting fund managers. One problem they faced was an inability to determine whether the funds possessed a genuine ability to outperform their benchmarks. The study shows that chasing past performance tends to be ineffective. A second problem is that the universe from which they select is stacked against them. Recent research cited in the Ellis article shows 24% of funds materially underperforms their index, 75% roughly match it, and only 1% materially beat their index after fees. Second question: why would you want to spend your resources selecting funds when the contribution to your success is among the least beneficial? Studies over time show better than 90% of the variation in returns are derived from how you allocate your assets among different security types (stocks, bonds, etc). A minimal benefit comes from how funds try to exceed the asset classes they are designed to match (such as the style boxes of Morningstar, etc.). There is an interesting debate on this topic among some of the studies which can help inform your judgment. In a an article summarizing the debate, The Importance of Asset Allocation by Roger Ibbotson, he explains that the 90% can be broken down into two components: general market returns and returns from varying your exposure to the market. He assumes you already decided to invest in the markets and your asset allocation decision may be to change from say 60% stocks to 70% stocks. In that scenario studies show the asset allocation decision produces only slightly greater impact on returns than mutual fund selection. But importantly, we differ on whether you should automatically decide to invest in the market or not. You should begin by looking at the expenses you need to pay over your lifetime and measure how your investments will be able to pay for them. The best match is often Treasury Inflation Protected securities (TIPs), which can be used as a starting point. From there you want to look at the value of adding different asset classes to your upside potential and downside risk for being able to pay those expenses. Why and how to use such an approach is described in other articles. So before you venture off to select a fund, why do you feel that you or your advisor are better able to spot the 1% of fund managers that can provide genuine value over simply buying an index fund? Then why are you paying everyone so much of your precious resources to accomplish so little. Instead you will be better served spending far less money and time on deciding how to invest your overall portfolio safely to produce the income you need in retirement. You can accomplish a great deal more for a lot less. Not discouraged? So many of the sales pitches are still ringing in your ears and you want to see for yourself? Or if you want to look at the characteristics of funds more in the line of the Graham or Buffet philosophy, here is a system using Morningstar to screen funds quickly and easily to see if they are worth the cost: If you've made it this far, please email us feedback - tell us what you think and if there is any way to be more helpful. Legal - The purpose of this site and all services offered are educational in nature and not to provide any investment advice, planning or recommendations of any securities. The purpose is to educate you to make your own financial decisions, or prepare you to evaluate your financial advisors with confidence so you can gain trust in the services they provide.

|

Integrated Financial Education: Westchester NY - 168 Bell Rd, Scarsdale, NY 19583 914-648-0492