Integrated Financial Training: Westchester NY |

|

Empowering you to Manage your Money and your Happiness |

|

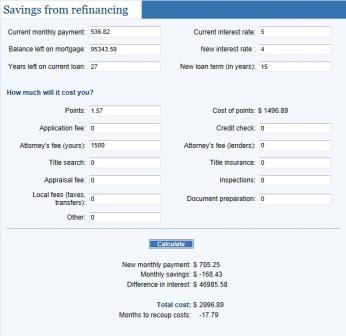

"By method and discipline are to be understood the marshaling of the army in its proper subdivisions, the graduations of rank among the officers, the maintenance of roads by which supplies may reach the army, and the control of military expenditure." The Art of War In this country we are very fortunate. In some countries most mortgage loans are variable rate without caps, there are often prepayment penalties on fixed rate loans and if you default, the debt follows you where ever you move. In this country when you take out a variable rate loan, they typically have adjustment caps. We also have access to 30 year fixed rate loans with no penalty for paying it down. Interest rates have been fairly volatile. So when rates go up, we keep our fixed rate (and some mortgages allow you to pass them on to the buyer), but when rates fall we can refinance to a lower rate and save on our payments. This refinance option is somewhat complex and can be valuable, but perhaps too difficult to value for the typical household. Unfortunately, to save a few dollars people sometimes bypass this valuable instrument to take out floating rate loans only to find when they want to refinance that they cannot. Also, when comparing loans to the extent the maturities differ there can be problems when we don't know the rate one loan will be rolled at in the future. We can fix problem when there is a natural end date for the analysis such as moving. For the purpose of this article we will provide the mathematical treatment needed to analyze two different loans up to a specific horizon period to determine whether it makes sense to refinance the loan or not. There will be an outstanding issue regarding the value of the option as alluded to above, but this should cover the most important aspects of the decision. We compare the results of a simple analysis with an online calculator for mortgage refinancing from a reputable company. When making important decisions, we sometimes use tools to help us bear them out. We should consider our tools carefully to be sure they will provide proper direction for us. Let's take the example of a 5% mortgage loan fixed for 30 years. I have held it for 3 years and the rates are now 4% for a 15 year mortgage. If I plan on staying in the home for another 4 years, does it make sense to refinance the loan at 4%? Say the closing costs on this $100k loan are $3k. This analysis is assumes a 25% all in marginal tax rate (federal & state) and half of the $3k closing costs are tax deductible. Below is an analysis of a typical online mortgage calculator:

You will note that since the payment is higher on the new loan, the program assumes you can never recoup the initial expenses of the refinance (as the negative number of months to recovery shows). They do not consider taxes, the timing of when the respective payments are made or the difference in the loan balance as time wears on. In a sense they are ignoring the fact that the interest rate is lower and the higher principal payments are really going to pay down the loan, thus saving money. We can adjust for these problems using excel assuming you have a rudimentary understanding how the program works:

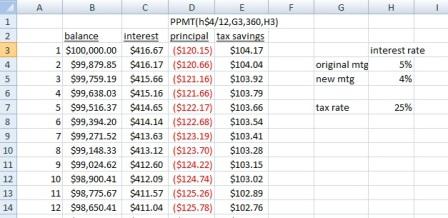

The A column denotes the month starting with 1. B denotes the outstanding balance which is simply reduced by the principal payment each month from column D. The formula from D uses present value math (instruction on the underlying theory of the time value of money can be found at the top of the resources page) and is shown in cell D1. The interest is simply the 5% rate times the balance. The tax savings is the 25% tax rate times the interest payment. Complete row 3 and 4 this way and then you simply take the cells a4 to e4, copy them and paste them below to complete 360 months. As a check, in month 361 the balance should be zero. The next step is to do precisely the same thing for the second mortgage loan, but use the 4% interest rate and 180 months for the term in the PPMT() formula above. For the balance of the loan we assume you finance the closing costs net of the tax savings, so here you increase the loan balance by $3,000 in closing costs less 25% of the $1,500 that was tax deductible. Now you are ready to do the comparison:

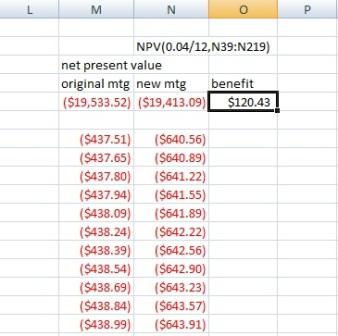

You take the payment for the original mortgage and subtract the tax savings for each month. You do the same for the new mortgage. This represents the monthly cost of each loan after taxes. Note the payments after taxes are much higher on the new mortgage. This is because the principal is being paid down. So at the very bottom of the new mtg column you have to include the difference in the loan balance that needs to be repaid when the house is sold or refinanced, or $10,957.35. (For organizational purposes you could also just put the balance left to be paid for each loan in month 49, but the net number is the same as this way). To determine which is the better deal we use a simple NPV calculation shown at the top of the spread sheet. This equates all of the monthly spending or savings in the future to one single sum today based upon the 4% interest rate charged on the loan. (For further information, see the time value of money theory cited above.) Now it is simple to see which loan costs more. So here we find that the present value of the old loan shows a cost that is $120.43 higher after 4 years than the new loan. This makes intuitive sense. If you pay 3% or so of your loan balance to lower your rate by 1% and pay down the debt more quickly, you should save money at some point in time. Here it takes roughly 4 years. Unfortunately, if you want to find the break even period directly using excel, that is a bit cumbersome. The easiest way is to try a few different runs at the analysis and approximate it. According to the online refinance calculator it was physically impossible to save money. In fact, I lowered the cost to $1 for the refinance and it still showed a negative number for the number of periods it would take to recoup the loss, indicating the $1 cost of the refinance could never be made up. This outcome makes no sense. So it is important to look closely at the tools you use to make decisions. The online tool indicated that by lowering your rate and paying down your mortgage faster, it was impossible to save money in any circumstance. A simple analysis here shows it takes about 4 years to recoup about 3% expenses up front. Checking your tools when you make any financial decisions is probably a good idea. If you've made it this far, please email us feedback - tell us what you think and if there is any way to be more helpful. Legal - The purpose of this site and all services offered are educational in nature and not to provide any investment advice, planning or recommendations of any securities. The purpose is to educate you to make your own financial decisions, or prepare you to evaluate your financial advisors with confidence so you can gain trust in the services they provide. |

Integrated Financial Education: Westchester NY - 168 Bell Rd, Scarsdale, NY 19583 914-648-0492